Irrevocable Living Trust Michigan

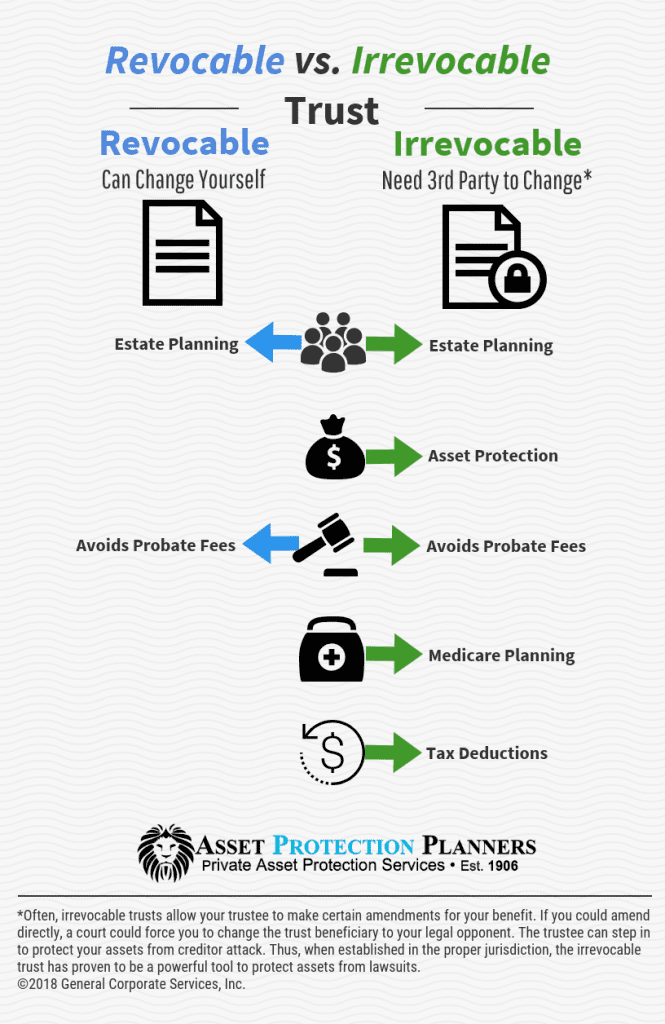

An irrevocable trust is not right for everyone as it does allow for less flexibility than a traditional revocable living trust but it can greatly benefit certain people.

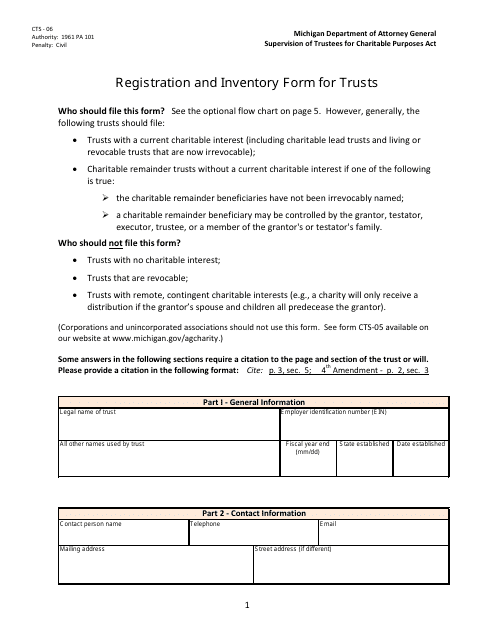

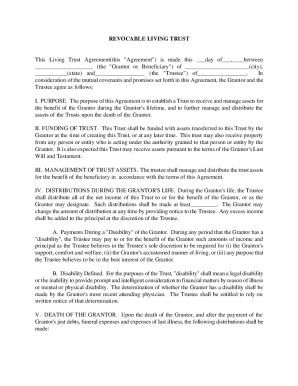

Irrevocable living trust michigan. You should consult a qualified estate planning attorney to get counseled on all your options before creating an irrevocable trust. Whereas a will necessitates a court to probate litigate and approve and distribute an estate to its beneficiaries a living trust avoids probate altogether. The settlor of the trust must intend to create a trust at the time when the trust is created. Michigan living trust forms irrevocable revocable the michigan living trust acts much in the same way as a will with certain important differences.

It is called a living trust because it is created and takes effect during the maker s lifetime in contrast to a will which does not take effect until after the death. There are many irrevocable trusts available that are quite flexible and grantor friendly. In order to create a valid trust there are certain requirements that must be satisfied. Do you need a will revocable living trust or an irrevocable trust.

For an example a grantor can impose an age restriction on the asset distribution or a require that the assets be spent only on certain. Also called an inter vivos trust a revocable living trust allows you to use your assets while they are in trust during your lifetime. A living trust in michigan can be a valuable estate planning tool that gives you control over your assets and which offers privacy. A living trust likely won t impact your taxes.

Download a michigan living trust form which is a way to transfer property and assets to a separate entity for the benefit of another. Download this michigan irrevocable living trust form which is a way to direct your assets and property to your beneficiaries with continuity and flexibility and privacy. A trust provides flexibility because the grantor the person creating the trust can direct the assets to be paid at certain point such as when the beneficiary reaches a certain age or for a certain purpose such as for the. Benefits of an irrevocable trust.

Settlor must intend to create a trust. Still if you re planning an estate you should know about the michigan estate tax and the michigan inheritance tax estate tax is levied on the estate of the deceased before assets are passed on to heirs. Living trusts and taxes in michigan. A revocable living trust is created for the purpose of holding ownership to an individual s assets during the person s lifetime and for distributing those assets after death.

A trust provides flexibility in that a grantor can designate when and how the assets will be distributed to the beneficiaries. The michigan revocable living trust is a legal instrument which is used to avoid probate when performing the disposition of an estate the creator of the trust the grantor will transfer the ownership of their property into the trust often naming themselves as the manager of these assets trustee during their lifetime.